Dominican Republic Offshore Haven For Expats

April 13, 2017

Dear Offshore Living Letter Reader,

The Dominican Republic first came onto my radar in 2005. It was the country’s undervalued beachfront property that got my attention back then.

I was among the first to shine the light on the DR for American property investors, but its miles and miles of soft-sand beaches had been attracting foreign tourists and European investors for decades before that. The French, especially, have been moving to and investing in the Dominican Republic for generations.

Today I want to focus your attention on the Dominican Republic Offshore Haven For Expats and the bigger-picture

Now that I’ve gotten to know it as well as I have, I believe this island nation is as close to perfect as an offshore destination gets. It checks nearly every box on my flag-planting list.

Dominican Republic Offshore Haven For Expats I’d go so far as to describe it as the world’s best offshore haven.

For the past three years the Dominican Republic’s economy has been the fastest growing in the Americas. The country enjoyed growth rates of 7% per year in 2014 and 2015. 2016 saw 6.6% growth and 2017 looks strong after the first quarter of the year thanks largely to millions of tourism dollars from North American and European travelers flocking to those sandy beaches I mentioned in growing numbers.

Alongside economic growth, the country’s re-elected President Danilo Medina has made education a priority, sponsoring literacy and vocational training programs for adults and building 2,500 new schools during his four years in office so far.

“The current administration is working hard to get this country beyond developing-world status,” one local businessman I spent time with recently told me.

The country’s infrastructure has improved dramatically since my first visit. Today new highways connect most of the resort and beach areas. The colonial zone in Santo Domingo is enjoying a facelift. New roads and sidewalks are being built, and utility cables are being buried underground.

More flights from the United States make the island more accessible, and major international hotel chains are targeting the DR, specifically Santo Domingo, for new properties. Recently opened are a JW Marriott and an Embassy Suites by Hilton. Under way are an InterContinental and a Hard Rock Hotel.

Meantime, Carnival is bringing a ship a day to Santo Domingo’s cruise dock.

The DR sees about 6 million tourists per year; about 60% of these are from North America. President Danilo’s administration is trying to attract more Chinese tourists and has also targeted Israel with success. Charters arrive regularly from that country.

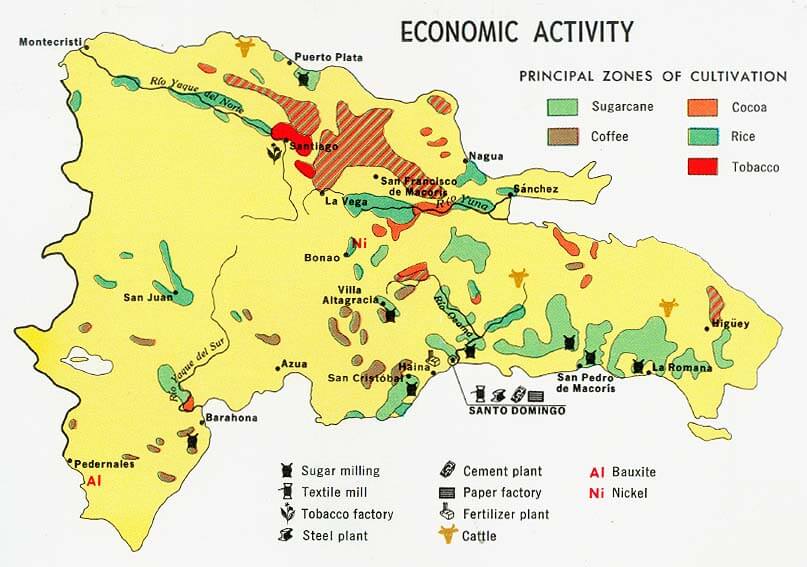

Beyond tourism, the Dominican Republic’s economy relies on agriculture (bananas, coffee, and cocoa) and mining.

Dominican Republic Offshore Haven For Expats That’s the country big picture.

How does the DR stack up as an offshore haven specifically? It’s a top-tier choice for these flag-planting activities in particular:

- Residency: A

- Citizenship: A

- Investing: A

- Taxation: A

- Banking: B+

The reasons to target the Dominican Republic for residency (either as a backup or because you’d like to live in the country) and alternative citizenship are compelling. This country offers some of the easiest and cheapest residency options available anywhere.

Generally speaking, gaining a second citizenship takes time or money.

The cost of economic citizenship from Dominica (not to be confused with the Dominican Republic), for example, will run you a minimum of $100,000 plus fees for an individual and at least $175,000 plus fees for a couple.

Furthermore, Dominica is a budget choice in this context. Other economic citizenship options are more costly.

If you don’t have or aren’t willing to spend the money to purchase second citizenship, you have to put in the time. Most countries require at least five years as a legal resident before you become eligible for naturalization.

The Dominican Republic requires only three years of residency… and that can be fast-tracked.

The Dominican Republic offers ordinary and fast-track residency options. The fast track includes residency through investment as well as a program for retirees who can prove $1,500 a month in pension income or $2,000 in non-pension passive income.

Obtain residency under a fast-track option, and your naturalization process is fast-tracked, as well. You can start the application process for naturalization after just six months rather than waiting the full three years of residency. This means that you can complete the naturalization process in 12 to 18 months from the time you obtain your residency… and the speed of residency processing continues to improve, as more staff is added to the department.

You can’t count on this in every case, but it can be possible to have your residency card in as few as 30 days.

The invest-for-residency option requires an investment of $200,000. However, unlike economic citizenship options where the “investment” is in fact a donation to a local development fund, you get your $200,000 back… plus associated investment profits.

Beautiful Las Terrenas on the Samana Peninsula

Beautiful Las Terrenas on the Samana Peninsula

To qualify for the invest-for-residency option, you could put your money in a government bond, which are currently paying tax-free (in the DR) interest in the 3.2% range. Or you could put your money in a bank CD to earn between 3.5% and 4%, depending on the terms.

Alternatively, you could set up a company to start a business… or you could set up a company to manage a real estate investment (that is, a rental property).

The option to qualify for residency through an investment in a bank CD is relatively recent. The regulations, requirements, and opportunities associated with qualifying for residency and a passport in the Dominican Republic are changing in real time as the government is working aggressively to attract more foreign investment and more expats and retirees interested in living in the country.

Bottom line, this playing field is continually changing for the better.

I’ve written often over the past few years about real estate investment opportunities in this country. I am as bullish as ever on property markets in the DR in general and in specific target regions in particular. I have been researching and scouting and intend to make a significant investment in property here in 2017.

The taxation in the Dominican Republic is as good as it gets. This country taxes on a jurisdictional basis. This means that, as a resident, you’re taxed only on what you earn in the DR with an exception for some foreign investment income. nonresident are taxed on any income earned in the country.

Tax rates are relatively low, with the top marginal tax rate set at 25%. The corporate tax rate is 27%, but, like individuals, DR companies are taxed only on income earned in the country.

The one higher-than-average tax is capital gains tax, which is 27%.

The Dominican Republic has fewer banks and many more limited private and investment banking options than Panama. However, DR banks are more open to working with foreign (including American) clients.

In addition, DR banks will lend to foreigners for the purchase of real estate.

Lief Simon

P.S. We’ll discuss all options and opportunities on offer in the Dominican Republic right now—for living, retiring, investing, banking, and diversification—at this year’s Live and Invest in the Dominican Republic Conference taking place in Santo Domingo May 17–19.

Today and tomorrow are your last chance to register for this, the only Dominican Republic event on our 2017 calendar, taking advantage of the Early Bird Discount to save up to $500.

Final 48 Hours: Join Us In The Caribbean Next Month

And Save Big

The Early Bird Discount for our Live and Invest in the Dominican Republic Conference expires this week. While the Early Bird Discount remains in effect, you and your significant other can register to attend at a cost of two for one. (You may be eligible for further discounts.

But you must hurry… this opportunity expires at midnight, Friday, April 14…

If you dream of waking up every morning to a view of dazzling white-sand beaches, swaying palm trees, and calm, clear-blue waters… but crossed the Caribbean off your list because you thought it was beyond your budget… Then I have very good news for you: The Dominican Republic could be your greatest discovery yet…

You’ve got to come see for yourself. You can arrange to do that at a significantly reduced cost when you take advantage of the Early Bird Discount and register now for our Live and Invest in the Dominican Republic Conference.

A fantastic article about Dominican Republic Offshore Haven For Expats by Leif Simon I highly recommend that you join him and all the experts at the “Live and Invest Overseas” conference you wont regret it!

You can see the original link to this great article by pressing this “The original article”

Category : Blog &Dominican Republic &Investment &Property